Instant Offices has released their annual US Flexible Workspace Market Report for 2018. In it, they detail changes in many aspects of the industry, from cities and states that are driving growth, to the growth of the niche operator, to evolution of flexible workspaces as a whole. Let’s take a look at some of the biggest takeaways from the report.

Cities/States Driving Growth

The three states with the largest quantity of centers are also the three that are growing the fastest. New York, California, and Texas are growing at an average of 12%, while the rest of the nation showed 4% growth. As expected, New York City was the biggest market within New York State, while San Francisco and Los Angeles mainly drove growth in California. Simultaneously, high demand for Dallas office space for rent turned the metro into Texas’ fastest-growing market for flex space.

An interesting note is that the top 20 US markets contain more than half of the total market share. Even though growth has continued to spread nationally, the biggest players are clearly still dominant.

There is approximately 80M sq ft of flexible space in the US, the largest market globally. However, the UK, has between 50-60M sq ft of flexible space. The UK has approximately 5x fewer residents, and is about 40 times smaller in size than the US! So it’s easy to see why that market is so valuable to investors and operators worldwide.

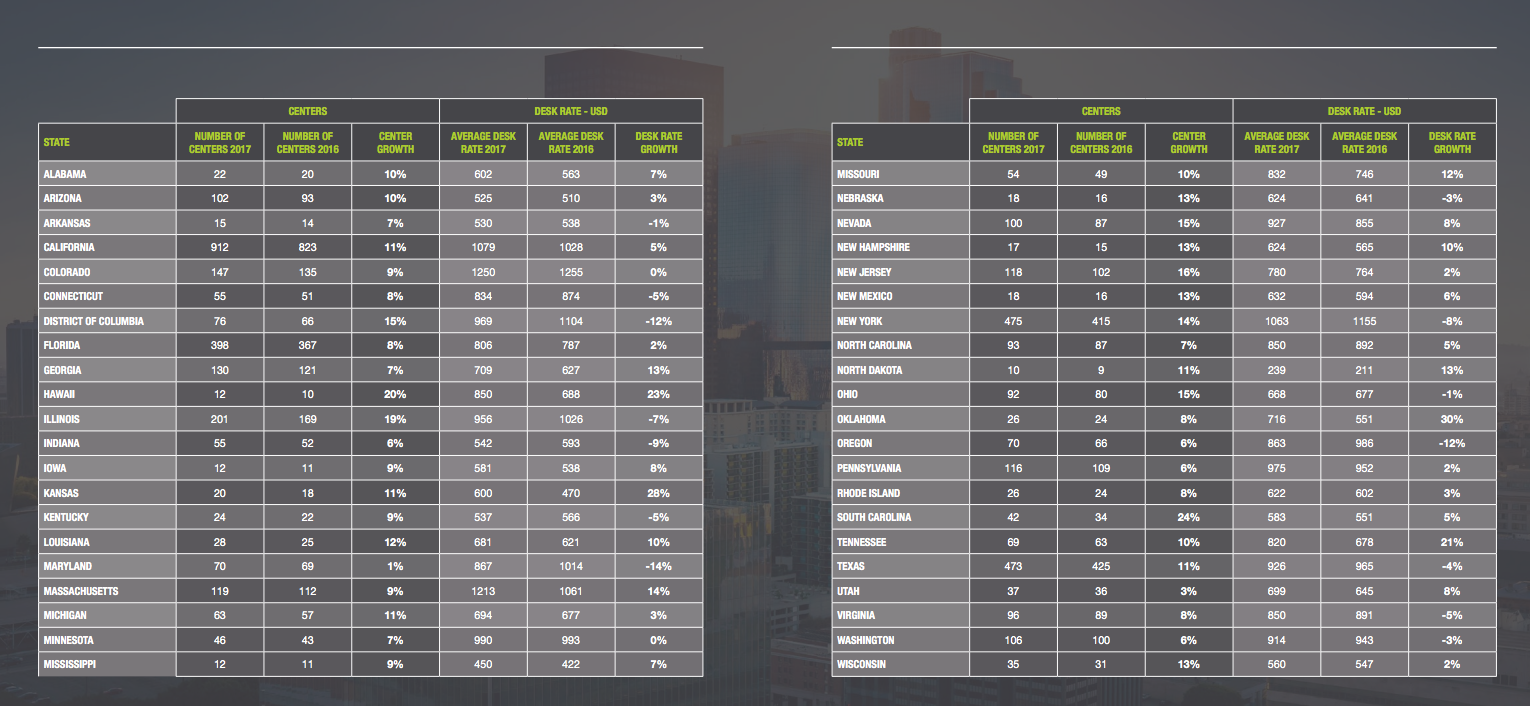

The most expensive states were Colorado and Massachusetts. Their desk rates were $1250 and $1213, respectively, while the average rate across the US was much lower, approximately $763 in the past year. Desk rate is defined as the amount to procure one desk per month.

Boston, Austin, San Jose, and New York City showed the largest percent growth in total number of spaces year over year.

Diversifying

Not only is the total number of spaces continuing to grow, but a trend clearly shows that executive suite style centers, pure Coworking locations, and hybrid models are all growing. Meaning operators in the market are continuing to diversify.

Also, a growing number of operators are franchising, facilitating expansion, in the hopes of increasing their market share.

Even though the huge players such as WeWork and Regus, among others, continue to have a massive foothold in the US and overseas markets as a whole, more than 50% of all flexible workspace centers in the US are now operated independently.

Niche Spaces

Continued growth of niche operators is also a trend revealed in the study. Whether its all women spaces such as The Wing, clubhouse spaces such as Voyager, or upscale hospitality based locations like Serendipity Labs, all these spaces are gaining a larger market share year after year.

Evolving Workspace Market

While serviced offices still have the largest share in the market, Coworking spaces and hybrids are both showing continued growth. This coincides with average age. Serviced offices are, on average, about 8 years old. Hybrid offices and Coworking spaces are less than 4 years old on average.

So from 2016 to 2017, the percentage of serviced offices/executive suites dipped from 66% to 62% and hybrid and Coworking grew from 34 to 38%. For only a one year sample, the gap closed from 32 to 24%, which is certainly significant.

A huge majority of operators only have locations in one city, 93% to be exact. Although that still represents an overwhelming majority, the total number of operators with sites in multiple cities actually increased by 11% year to year.

One stat we found to be absolutely amazing was the amount of international operators of US flexible workspaces.

Follow along here: According to Instant Office, only 1% of operators in the US are international (22 operators out of 2138). However, that 1%, those 22 individuals, actually run 28% of the spaces in the US! Those 22 individuals run 1,332 spaces! Incredible how they have gained a massive market share while 99% of operators are domestic.

Landlords

Part of the report was an interview with some of the biggest US landlords. Some of the notable takeaways:

Two thirds of landlords surveyed said they would use a third party to operate the workspace.

The biggest obstacle they cited was a perceived lack of profitability.

33% of the landlords in the survey actually offer shared space, which I actually found to be a decent number given how it will continue to grow. But 66% said they are aware that flexible space is a trend that will impact their business.

The biggest amenities occupiers require is ultra fast internet. Not a surprise here. Custom branding in the office was last in the survey.

So basically, the report is full of fascinating insight into our world of flexible workspaces. To learn more about Yardi Kube and how our platform can benefit your workspace, click here.

To download the free Instant Offices US Market Report in its entirety, click the link below.