Home vs. Office Preference Survey: 41% of Employees Would Not Consider Jobs That Don’t Offer Full Remote Work

The global workplace is in the midst of one of the most significant shifts in modern history. Where offices were once the unquestioned hub of productivity, collaboration and career growth, today’s professionals are navigating an evolving spectrum of work settings. Remote and hybrid models have emerged as mainstream alternatives to traditional onsite employment, redefining expectations for flexibility, autonomy and organizational culture.

To better understand these shifting dynamics, we decided to conduct a survey exploring the current work arrangements, willingness to adapt and preferred balance between remote and office-based work of employees that are currently in search of coworking spaces. The results shed light not only on where people work today, but also on how they envision their ideal work environment. Responses span across remote, hybrid and onsite professionals, offering a window into the diverse motivations and hesitations that characterize the modern workforce.

Highlights

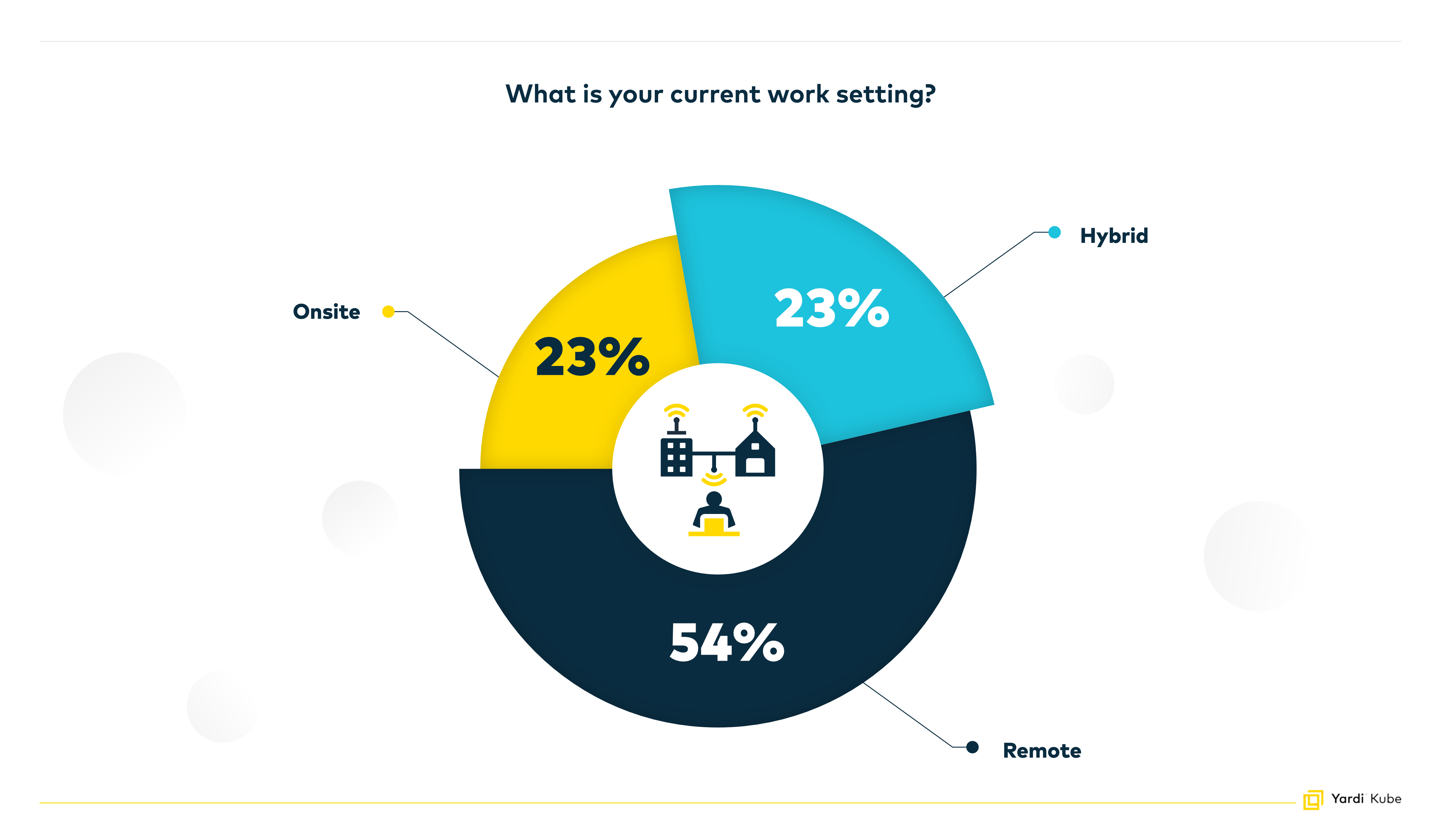

- 54% of respondents work remotely and 23% embrace hybrid work

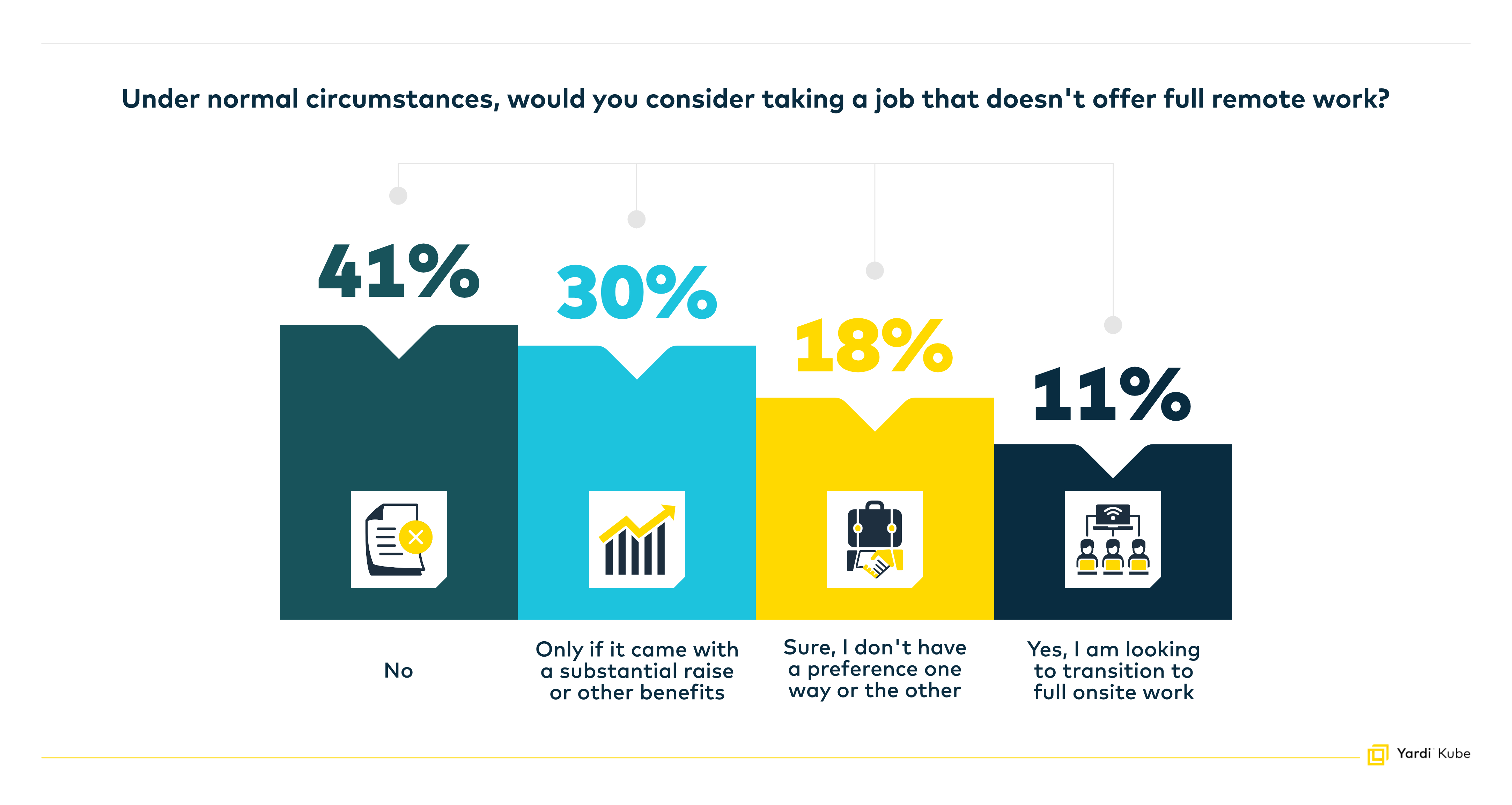

- 41% of employees would not consider job opportunities that don’t offer full remote work

- 11% of survey respondents are looking to transition to full on-site work

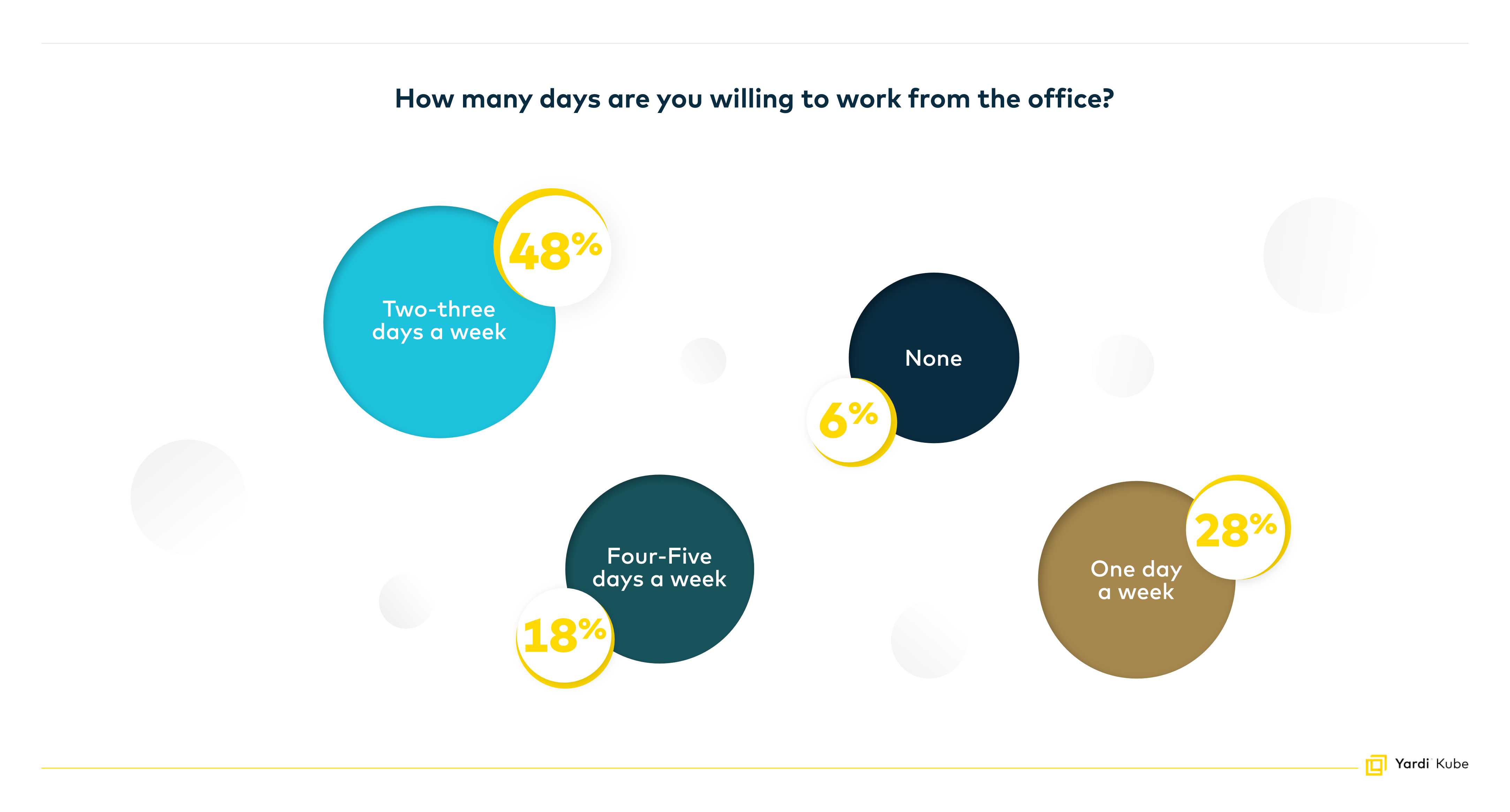

- Majority of employees (82%) would not work more than 3 days from the office

Current Work Settings: Remote Leads the Way

The survey begins by asking participants to describe their present work arrangement. The results reveal a clear tilt toward remote work, with 54% of respondents reporting working fully remote, compared with 23% who identified as hybrid and another 23% who remain fully onsite. This distribution illustrates the significant foothold remote work has achieved but also underscores that in-person work has not disappeared. Instead, the data suggest a “three-way split” workplace reality, where remote dominates but hybrid and onsite maintain notable shares.

Remote Workers: Strong Preference for Staying Put

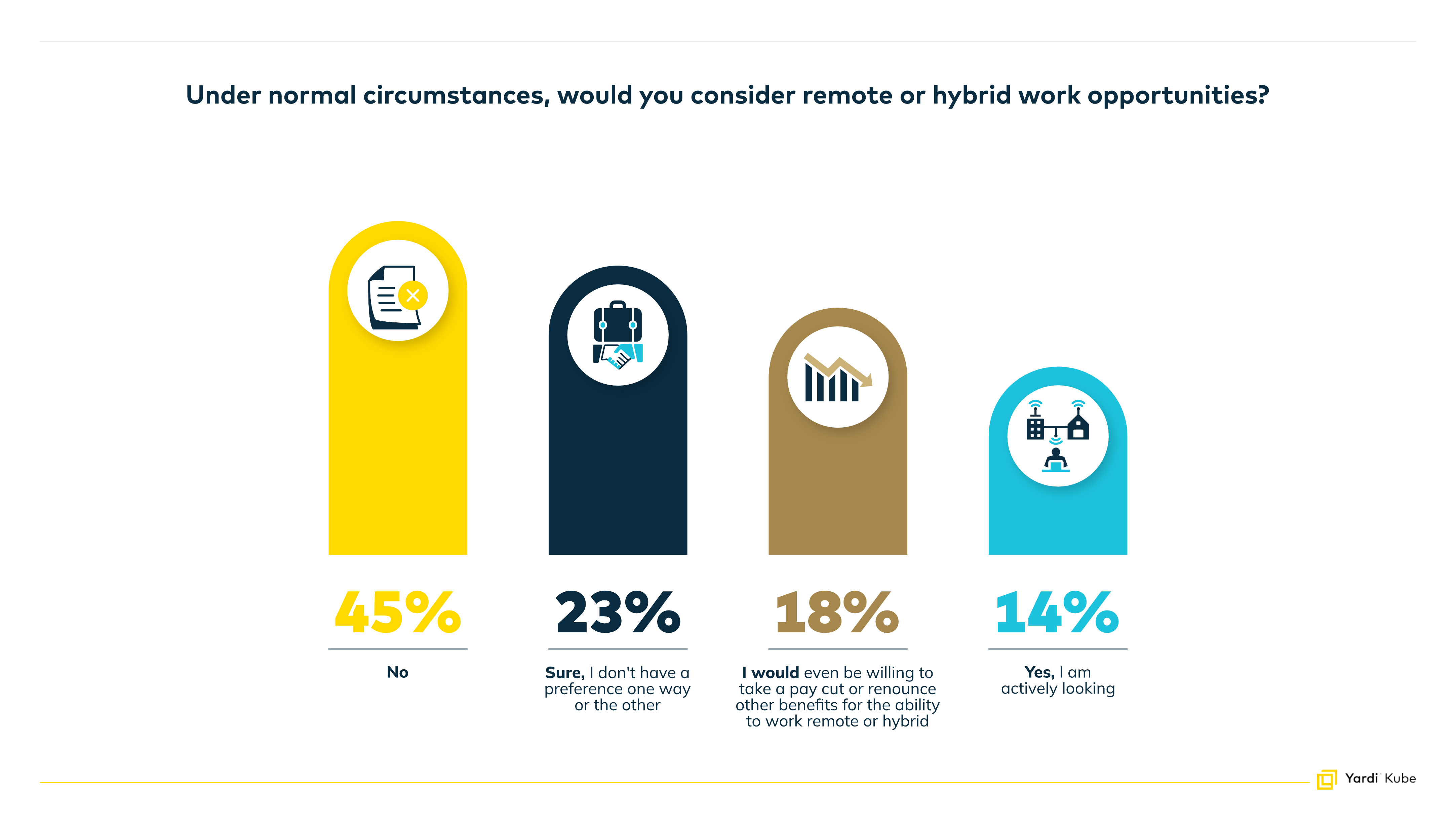

When remote workers were asked if they would consider taking a job without full remote options, 41% responded “no” outright. Another 30% said they would only consider such a change if it came with substantial financial or career incentives, while 18% expressed no strong preference either way. A smaller portion, about 11%, indicated they were actively seeking to return to full onsite roles. This distribution highlights that while many remote workers are deeply committed to their current setup, there is a meaningful minority who remain open to change – but largely for pragmatic reasons like salary increases or professional growth.

Hybrid Employees: Seeking Balance, Not Extremes

Among hybrid workers, the survey explored how many days they were willing to spend in the office. Nearly 48% favored a balanced schedule of two to three days per week, while 28% preferred just one day in the office. On the other end of the spectrum, 18% were comfortable with four to five days onsite, and 6% indicated they would prefer none at all. These figures reveal that hybrid workers are not monolithic: while many embrace the idea of blending remote and office work, their comfort levels vary widely. Employers setting policies around office attendance must therefore recognize that even within “hybrid,” preferences can diverge significantly.

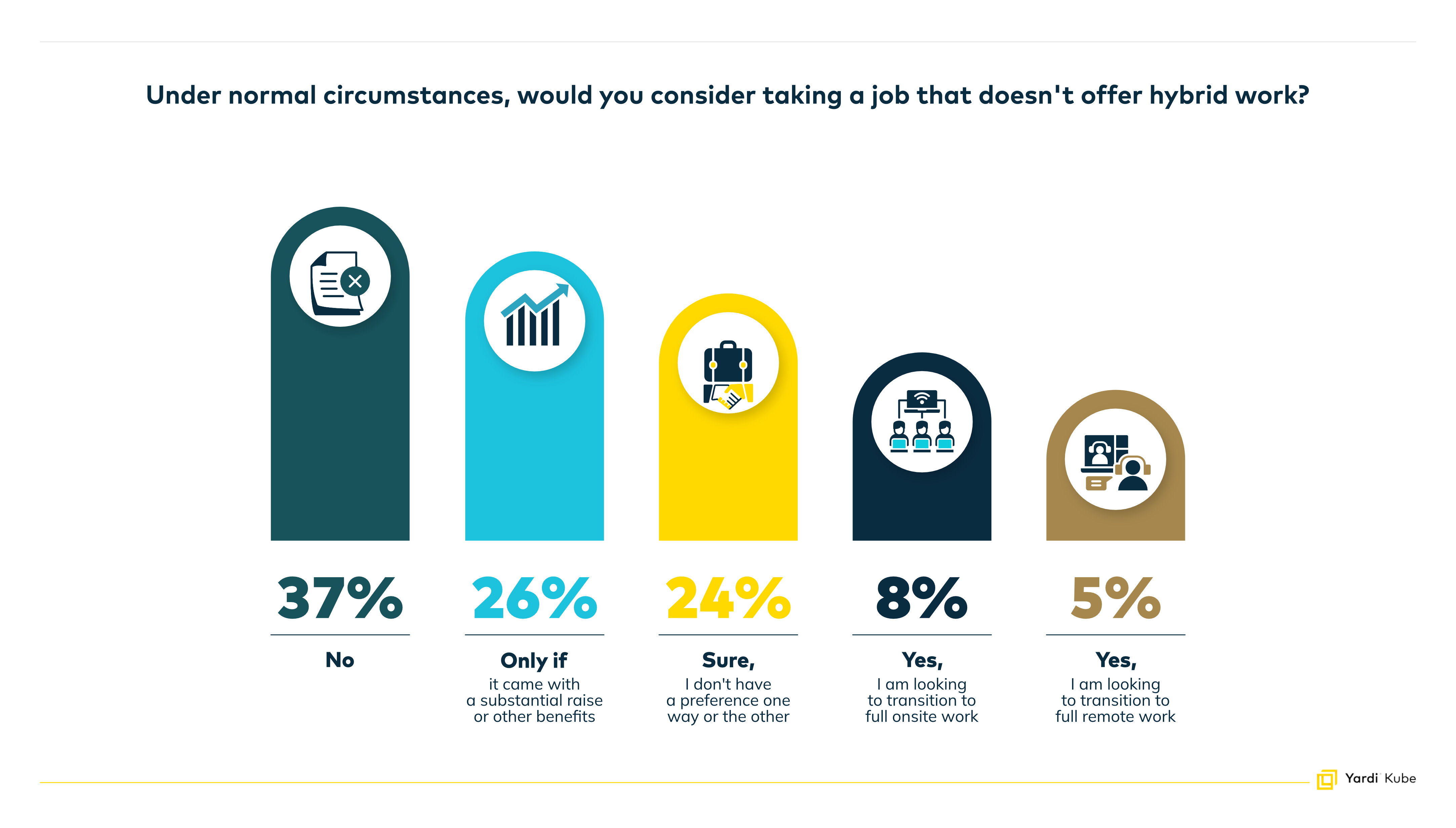

When asked under what conditions they would shift away from their hybrid setup, 37% said they would not consider leaving hybrid work, while 26% indicated they might switch if the offer came with significant financial raises or benefits. Meanwhile, 24% reported no strong preference, and smaller groups expressed interest in moving fully onsite (8%) or fully remote (5%). This illustrates that while hybrid employees are relatively satisfied with their arrangement, incentives and organizational opportunities could still sway some toward other models.

Onsite Workers: Openness to Flexibility

The survey also included responses from professionals working fully onsite. While the data show fewer onsite respondents compared to remote or hybrid, their answers signal an important trend – many are open to hybrid or remote possibilities. A significant portion expressed willingness to transition if the right incentives were present, particularly around work-life balance or career opportunities. These responses suggest that while onsite work continues to hold importance in some sectors, its dominance is no longer assumed, even among those currently engaged in it.

Broader Implications for Employers

Taken together, these survey findings paint a complex picture of today’s workforce. Employees are not uniform in their expectations, but patterns do emerge:

- Remote workers value autonomy and resist losing it, unless compensated by substantial financial or career advantages.

- Hybrid employees seek balance but vary in how much office time feels “just right.”

- Onsite workers are not locked in and may be enticed by hybrid or remote opportunities, particularly when aligned with personal or professional goals.

For employers, the key takeaway is flexibility. A one-size-fits-all policy is unlikely to satisfy diverse employee groups. Instead, organizations that adopt adaptable models, allowing for tailored arrangements and recognizing individual differences, are best positioned to attract and retain talent in a competitive labor market.

Coworking Spaces: A Boost for Focus, Productivity, and Connection

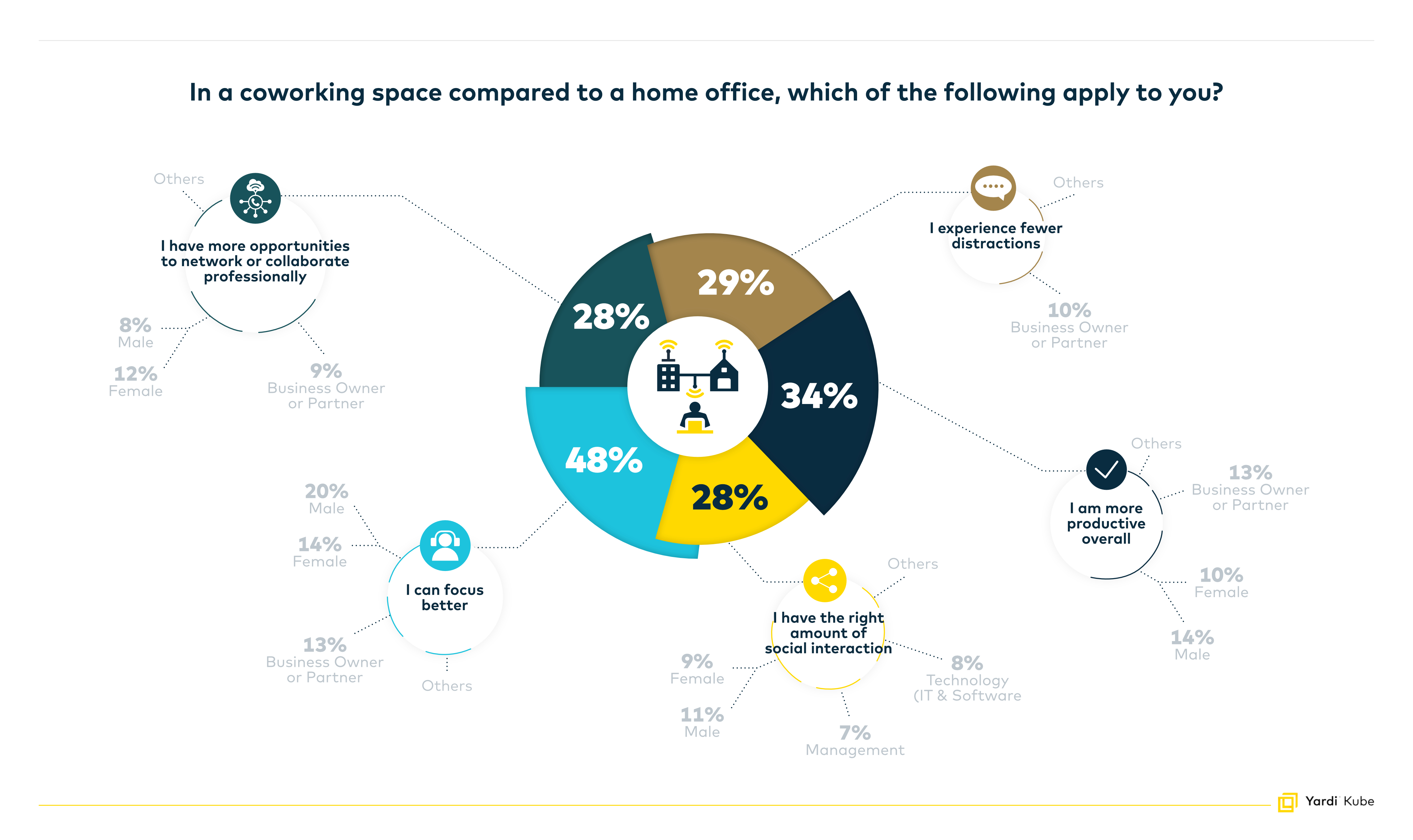

The survey shows that coworking spaces provide substantial advantages for many workers when compared to a home office. Nearly 48% of respondents’ choices indicated that they are able to focus better in a coworking environment, while 34% that they were more productive overall and 32% indicated improved time management. Among business owners and partners, 26% indicated they can focus better and be more productive in a coworking space. Along the same line, 10% of their responses also indicated they experience fewer distractions. Furthermore, a significant 34% of male respondents’ choices compared to 24% of female responds indicated that both focus and productivity are more easily achievable in a coworking space.

Professional and social opportunities were also a factor, with 28% highlighting networking or collaboration benefits and another 28% valuing the right amount of social interaction. 12% of female respondents’ choices indicated that they are especially fond of the networking and collaboration benefits and 11% of male respondents like having the right amount of social interaction in coworking spaces. For business owners and partners, networking and collaboration opportunities are important, as 9% indicated this as a benefit of coworking spaces, while 7% of managers chose that they like having the right amount of social interaction. Also, for those working in technology, IT and software, having the right amount of social interaction is important (8%). These results illustrate that coworking environments deliver not only productivity but also a sense of community that can be difficult to replicate in a home office.

Practical considerations further enhance the appeal of coworking. About 30% said these spaces helped maintain a healthier work-life balance and 29% experienced fewer distractions compared to home. This challenges the assumption that home offices are always more conducive to concentration. Additionally, 25% of respondents’ choices indicated that they felt more motivated to start the workday in coworking settings, suggesting that physically leaving the home can provide a mental and energetic boost.

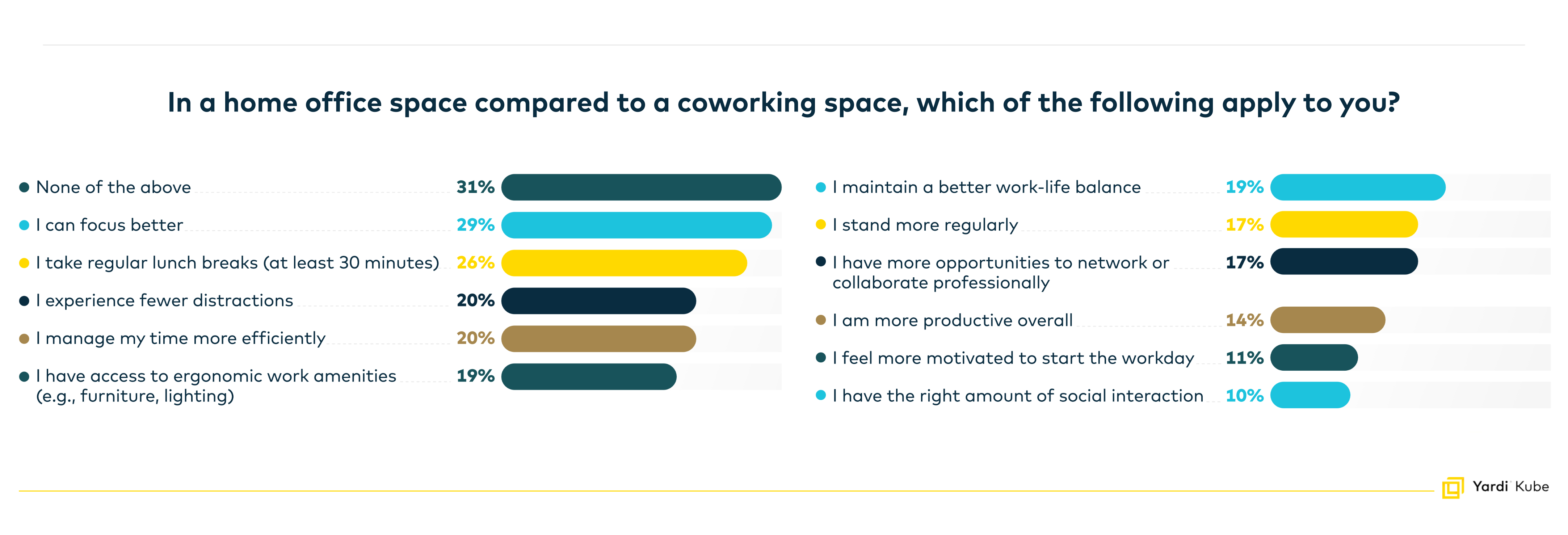

Why Some Workers Prefer the Autonomy of Home Offices

Home offices also offer meaningful benefits that appeal to a substantial share of workers. 31% of respondents’ choices indicated none of the coworking advantages applied when working from home, showing that for nearly a third of participants, the home environment comes with some challenges. This applies in particular to female respondents (12%) and to business owners and partners (17%). At the same time, 29% reported better focus at home and 26% said they were more likely to take regular lunch breaks, like 11% of the male respondents, suggesting that home offices can foster both concentration and healthier daily routines.

Efficiency and comfort were also emphasized. 20% of respondents’ picks reported managing their time more effectively at home, while another 20% said they experienced fewer distractions compared to coworking spaces. Additionally, 19% highlighted access to ergonomic amenities, such as proper furniture or lighting, and 19% pointed to stronger work-life balance. These insights demonstrate that for some individuals, the comfort and control of a home office setup outweigh the structure provided by coworking spaces.

Other responses reveal the varied experiences of home-based work. 17% said they stood more regularly or had opportunities to collaborate professionally from home, while 14% reported being more productive overall. A smaller group, 11%, found themselves more motivated to start the workday, though only 10% reported having the right amount of social interaction at home. This last figure points to one of the biggest trade-offs: while home offices offer autonomy and convenience, they can also reinforce professional isolation.

What Employees Want Beyond Wi-Fi: Amenities That Matter

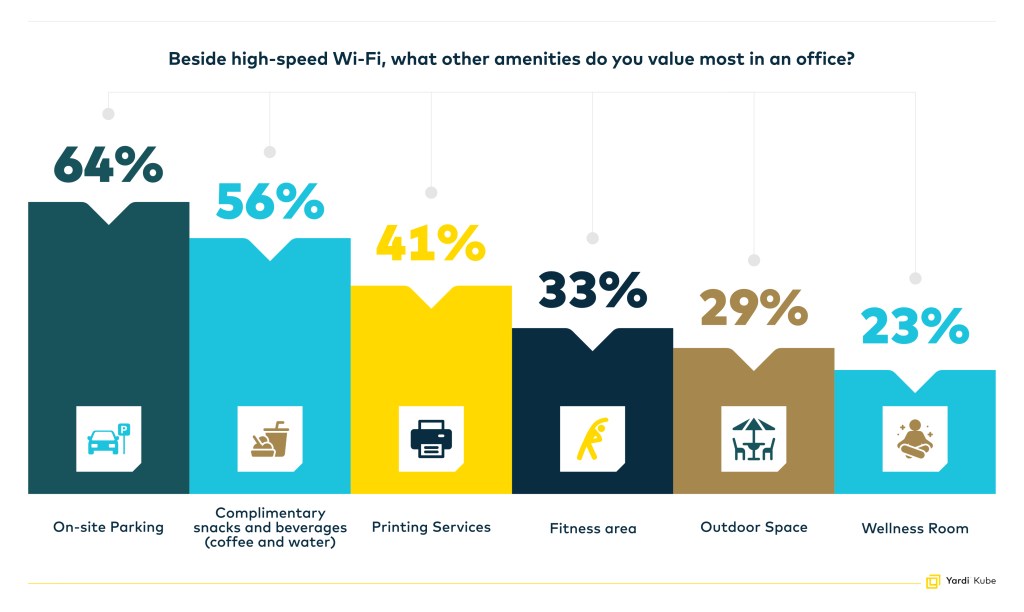

When asked about valued amenities, practical considerations dominated. 64% of respondent choices were on-site parking, making accessibility the most important factor by a wide margin. 56% highlighted complimentary snacks and beverages such as coffee and water, underscoring how small perks contribute to workplace satisfaction. Meanwhile, 41% of respondents’ choices still valued printing services, a reminder that traditional resources continue to play a role despite the increasing digitization of work.

Health and wellness emerged as another major theme. 33% of participants valued fitness areas, while 29% emphasized outdoor spaces, indicating a preference for environments that encourage physical activity and mental restoration. Another 23% noted wellness rooms, highlighting a growing expectation for offices to support holistic well-being. These preferences reveal that employees view the workplace as more than a space for productivity as they expect it to actively support their health and lifestyle.

Finally, a range of specialized amenities reflected diverse needs, such as showers, pet-friendly policies, mother’s rooms and daycare services, to name a few. While less common, these amenities reflect the importance of inclusivity and show how offices can stand out by addressing the needs of specific employee groups.

Looking Ahead: The Future of Work

The survey results not only capture current realities but also offer a glimpse into the future of work. The persistence of strong preferences for remote and hybrid arrangements suggests that flexibility has become a permanent feature of the professional landscape rather than a passing trend. For many, the office is shifting from being a daily requirement to serving as a collaborative hub, a space for networking and building culture rather than routine presence. Employees are also becoming more mobile in their careers, increasingly willing to change employers if their need for autonomy and balance is not met. As we look toward 2026 and beyond, the message is clear: flexibility is no longer a perk but a defining expectation. Organizations that embrace this shift and design adaptable, employee-centered policies will thrive, while those clinging to rigid structures may find themselves struggling to attract and retain top talent in an increasingly competitive landscape.

Methodology

The survey ran on CoworkingCafe.com from May 2025 to September 2025.

A total of 251 respondents from the U.S. and Canada participated.

The statistical confidence level for this survey is 95%.

Respondents were able to pick a single option for questions regarding their current work setting, remote work and hybrid work preferences and multiple options for amenities and benefits of home office vs. coworking spaces.

Answering all questions in the survey was not mandatory and based on their responses to Q1 they were redirected to the following questions. Those that picked “remote” in Q1 were redirected to Q2, then Q6 and then the rest of the demographic questions through the end of the survey. Those that picked “hybrid” in Q1 were redirected to Q3, then Q4, then Q6 and then the rest of the demographic questions through the end of the survey. Those that picked “onsite” in Q1 were redirected to Q5, then Q6 and then the rest of the demographic questions through the end of the survey.